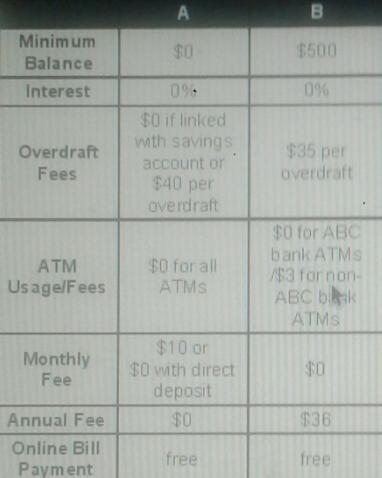

James has $1500 to open a checking account. He can maintain a monthly balance of at least $1000. He plans to use the ATM four times per month at his local branch. He does not overdraft his account and plans to use direct deposit. He also plans to pay his bills online and he averages 8 bills per month.Which checking account would be best for James?

A. Account B

B. Account A

Answers

The question is incomplete:

The image with the information of account A and B is attached

Answer:

B. Account A

Explanation:

The answer is that the checking account that would be best for James is account B because it doesn't require a minimum balance, the ATM usage fee is $0 for all ATMs, the monthly fee is $0 if he uses direct deposits as he plans to do, the online bill payment is free and the annual fee is $0 while account B has an annual fee of $36 making it more expensive.

Answer:

acc A

Explanation:

Related Questions

Jose owns a dog whose barking annoys Jose's neighbor Amy. Suppose that the net benefit of owning the dog is worth $400 to Jose and that Amy bears a cost of $200 from the barking. Assuming Amy has the legal right to keep Jose from having a dog, a possible private solution to this problem is that:

Answers

Answer: Jose has to pay $600.

Explanation:

Jose has to pay $600 to Jane for her inconvenience.

In Accordance with Coase theorem, when two conflicting parties exist, one has to ‘buy the right’ from the other party.

Which In this scenario or case, Jane has the ‘right to prevent Jose from having a dog’.

Thus, Jose has to pay compensation to Jane so that he can keep his dog and at the same time Jane is also compensated for the inconvenience which may arise later.

Answer:

that Jose pays Amy $350 for her inconvenience, and keeps the dog

Explanation:

In this specific scenario, since Amy has every legal right to keep Jose from having the dog, then a possible private solution would be that Jose pays Amy $350 for her inconvenience, and keeps the dog. This would cover Amy's costs from the barking as well as provide an incentive to let Jose keep the dog, while at the same time Jose is spending less than what the net benefit of owning the dog is actually worth. Thus turning this into a beneficial arrangement for all parties.

It is possible that a(n) ________ vertical marketing system can be more formally structured through strategic alliances and partnership agreements among channel members that agree to work in mutual cooperation. An example of this is the relationship between Walmart and Procter & Gamble.

Answers

Answer:

administered

Explanation:

An administered vertical marketing system is a system in which the process of taking the product from the manufacturer to the user is managed by one party because it has power and a big size that allows it to control the activities in an informal way. According to this, the answer is that it is possible that a(n) administered vertical marketing system can be more formally structured through strategic alliances and partnership agreements among channel members that agree to work in mutual cooperation because this is a system in which a big company is able to control the whole process in an informal way but this can be formalized by making agreements between the parties involved.

An investment adviser, age 33 and married, needs cash for the down payment to buy her first house. She asks her father if he can "help out" with the down payment. Her father is one of her advisory clients. Which statement is TRUE about this situation

Answers

Answer: The investment adviser can accept the money from her father if he gives it as a gift

Explanation:

Investment advisor operate within a certain principles and are bound from borrowing or withdrawing money for or from their customers except the customer is a banker or broker, but the investment adviser can accept a gift from the Father. This is just one of the ways to go about this as the other options won't work and would put the investment advisor profession at risk.

Creative Sound Systems sold investments, land, and its own common stock for $31.0 million, $15.1 million, and $40.2 million, respectively. Creative Sound Systems also purchased treasury stock, equipment, and a patent for $21.1 million, $25.1 million, and $12.1 million, respectively.

A) What amount should the company report as net cash flows from investing activities?

B) What amount should Creative Sound Systems report as net cash flows from financing activities?

Answers

Answer:

Creative Sound Systems

Net cash flows from investing activities:

Cash inflow from sale of investments $31 million

Cash inflow from sale of land $15.1 million

Cash outflow from purchase of equipment ($25.1 million)

Cash outflow from purchase of patent ($12.1 million)

Net cash flows provided by investing activities $8.9 million

Creative Sound Systems

Net cash flows from financing activities:

Cash inflow from issuing common stocks $40.2 million

Cash outflow from purchase treasury stock ($21.1 million)

Net cash flows provided by financing activities $19.1 million

An internal control system consists of all policies and procedures used to protect assets, ensure reliable accounting, promote efficient operations, and urge adherence to company policies. Evaluate each of the following statements and indicate which are true and which are false regarding the objectives of an internal control system.

1. Separation of recordkeeping for assets from the custody over assets is intended to reduce theft and fraud.

2. The primary objective of internal control procedures is to safeguard the business against theft from government agencies.

3. The main objective of internal control procedures is best accomplished by designing an operational system with managerial policies that protect the assets from waste, fraud, and theft.

4. Separating the responsibility for a transaction between two or more individuals or departments will not help prevent someone from creating a fictitious invoice and paying the money to herself or himself.

Answers

Answer:

Explanation:

1. True

Separation of record keeping for assets from custody over assets in custody over assets reduces theft and fraud . except in a case of collusion.

Fraud and theft of assets can be easily perpetrated and covered up when an individual combines the role.

2. False

Internal control focuses more on the internal operation of an organization rather than the external. Even though it can still be of impact in checking the excesses of external parties like the government agencies , but that is not its primary objective

3.True

Internal control's main objectives can be best accomplished when there is an operational system with managerial policies that protect waste , fraud and theft , being the major factors targeted to control

4.False

Separating the responsibility for a transaction between two or more individuals or departments is a major way of preventing creation of fictitious invoices and payment as it could have easily be detected if different individuals are involved in approval and payment of invoices.

A customer asks an agent for a valuation of his securities portfolio. Because the agent does not want to cause the customer to panic and sell his shares at a loss, the agent inflates the value of the stock. Under the Uniform Securities Act, this action is A) permitted because the agent was not recommending a transaction B) permitted because the agent determined that selling the securities was not suitable C) not permitted because the agent must not attempt to influence the market value of a security D) not permitted because the agent must not deceive the customer by misstating a material fact

Answers

Answer: not permitted because the agent must not deceive the customer by misstating a material fact.

Explanation:

From the question, we are informed that a customer asks an agent for a valuation of his securities portfolio and that because the agent does not want to cause the customer to panic and sell his shares at a loss, the agent inflates the value of the stock.

It should be noted that under the Uniform Securities Act, this action is not allowed because the agent must not deceive the customer by misstating a material fact. An agent should not deceive a customer and ethical behavior is also required.

A television manufacturer in South Korea had to simplify its televisions before introducing them to the Nigerian markets, as the country lacked the skills to repair the product in case of a malfunction. The local salesforce also did not have the sufficient knowledge about the installation of the product. The requirement that is influencing product adaptation in this scenario is

Answers

Answer:

The correct answer is "Technological Requirements ".

Explanation:

Throughout the field of computing and development of systems, technological requirements are considerations necessary to produce a request to make or action from such an organization to determine the expectations and needs of either a customer. Technical specifications may apply to technologies such as software, hardware as well as software-driven electronic equipment.So that the given scenario is "Technological Requirements "

John purchases a life insurance policy on his wife Betty where he pays the premium and he will receive the life insurance money when she dies. John is both the ________ and the ________ who will receive the ________ upon the death of Betty, the ________.

Answers

Answer:

Policy owner

Beneficiary

Face amount

Insured

Explanation:

John is both the “Policy owner” and the “Beneficiary” who will receive the “ Face amount” upon the death of Betty, the “Insured”.

The term policy owner is used to refer to a person who buys and pays the premium. At the same time, a beneficiary is a person who receives the face amount that was on the name of the insured (Betty).

It is given that John has bought the policy and paying the premium so he is the owner. Moreover, he is the beneficiary because he is getting the insurance amount after the death of betty who is insured.

The WaveHouse on Mission Beach in San Diego features the Bruticus Maximus, a ten foot wave, which tests the skills of even the most talented surf and wake board riders on the planet. WaveHouse is the only place in San Diego where this service is offered. You can ride B. Max for $40 for the first hour, $33 for the second hour, and $26 for the third hour. Charging a different price for subsequent hours is a form of:

Answers

Options:

A) monopoly regulation.

B) price discrimination among units of a good.

C) rent seeking behavior.

D) price discrimination among groups of buyers.

Answer:

B) price discrimination among units of a good.

Explanation:

By charging a different price for subsequent hours The WaveHouse would be discriminating their price on the basis of hours spent by buyers.

Remember, there may exist customers who usually spend lesser amount of hours on such activities; so they may ride for lesser hours, which means they are discriminated against in terms of the price paid for the service. Thus, the units of a good or service bought as in this case determines the price of the service.

Japan, due to a lack of undeveloped land, would be an unusual choice of location for a U.S. cattle company to set up local grazing operations. This limiting factor would be identified in what part of Porter’s determinants of national advantage?

Answers

Answer:

It is A. Factors of production

Explanation:

Marks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office expenses are allocated to the two departments using different allocation bases. The following information is available for the current period:

Office Expenses Total Allocation Basis

Salaries $ 42,000 Number of employees

Depreciation 22,000 Cost of goods sold

Advertising 45,000 Net sales

Item Drilling Grinding Total

Number of employees 1,200 1,800 3,000

Net sales $ 340,000 $ 510,000 $ 850,000

Cost of goods sold $ 95,000 $ 155,000 $ 250,000

The amount of the total office expenses that should be allocated to Drilling for the current period is:

A. $71,600.

B. $43,160.

C. $109,000.

D. $600,000.

$53,000.

Answers

Answer:

Total Office expense allocated to Drilling for this current period is $43,160

Explanation:

Office expense allocation to Drilling

Salaries = $42,000 x 1200 employees/3000 total employee = $16,800

Depreciation = $22,000 x $95,000/ $250,000 total COGS= $8,360

Advertising = $45,000 x $340,000/ $850000 total Sales = $18,000

Total Office expense allocated to Drilling= $43,160

In 2004, Jamal lost his job as a shipbuilder. His shipyard never reopened, and his very specialized skills as a shipbuilder were no longer in demand. Jamal's unemployment is best classified as _____.

Answers

The best way to describe Jamal's unemployment would be Structural

Machinery was purchased on January 1 for $51,000. The machinery has an estimated life of 7 years and an estimated salvage value of $9,000. Double-declining-balance depreciation for the second year would be (round calculations to the nearest dollar):

Answers

Answer:

$10,408

Explanation:

The computation of the depreciation expense for the second year using the double-declining balance depreciation method is shown below:

First we have to determine the depreciation rate which is shown below:

= One ÷ useful life

= 1 ÷ 7

= 14.28%

Now the rate is double So, 28.57%

In year 1, the original cost is $51,000, so the depreciation is $14,571 after applying the 28.57% depreciation rate

And, in year 2, the ($51,000 - $14,571) × 28.57% = $10,408

Hung and Suzanne’s company has instituted a new volunteering program where more experienced employees mentor the youngest employees, many of whom are fresh from college or internships. Hung signs up, but Suzanne does not. A few months later, how does Hung likely feel about having become a volunteer?

Answers

Answer: E) She feels more engaged in the company and in her primary role.

had to complete the question.

A) She enjoys it, but her colleagues think she is kissing up to the management.

B) She feels resentful, since she is essentially working for free.

C) She likes it but feels her mentees take advantage of her time, becoming a distraction.

D) She likes it but finds the extra time commitment a major problem.

E) She feels more engaged in the company and in her primary role.

Explanation: since she has taken up the companys new volunteering scheme/ programme after a few months Hung would feel more engaged in the company and in her primary role. This is so becau Hung has succed to pass down her knowledge and experience through the program to young interns who are new to the job world and lack the technical know how to perform such task and duties.

Two employers, A and B, pay the same wage but Employer A faces a more inelastic supply curve of labor than Employer B. Both firms are monopsonies but have similar outputs and technologies. Other things being the same, then in the long run?

A.) Both employers will employ the same amount of capital.

B.) Employer A will employ more capital than Employer B.

C.) Employer A will employ less capital than Employer B.

Answers

Answer:

B.) Employer A will employ more capital than Employer B.

Explanation:

Mike worked for Frank's Pizza as a driver. His duties consisted of making deliveries along a designated route. One day Mike decided to see his girlfriend, Jackie, who lived 50 miles out of his pizza route. While driving to his girlfriend's, Mike injured a pedestrian, Chuck. The accident was caused because of Mike's negligent operation of the delivery truck. Chuck is now suing both Mike and Frank's for personal injuries. Under the circumstances:

Answers

Answer:

Frolic

Explanation:

According to the given situation, Mike is a driver of Frank Pizza. He used to deliver pizzas with designated route. Mike wanted to meet with her girlfriend who is living 50 miles out of the route of pizza. Mike injured a pedestrian, Chuck, while driving towards his girlfriend's. The accident was caused as a result of Mike's incompetent delivery truck service. Now chuck is trying to claim from Mile as well as Frank Pizza company.

Here, Frank pizza is not responsible as mike was frolic of his own. Mike was frolic as he want to meet his girlfriend which does not come to his duties.

Therefore, It will also clear his employer of any responsibility, since he at the time was not operating on the route designated.

Marcus is a self-employed marketing consultant. He is good at helping his clients with their marketing challenges; however, he is not keeping up with billing his clients regularly or keeping track of his hours. He feels like the time he spends on these functions is taking him away from activities where he has more talent and ability. His small business needs to bill clients quickly to keep the business running. What would you recommend Marcus do?

Answers

Answer:

To outsource the accounting function to another firm.

Explanation:

Outsourcing: Outsourcing refers to a process in which the business is able to perform its work with the help of an outside firm that means they provide the work to the other firm so that the company could able to save the cost and time

Since in the question it is given that Marcus spending much time and away him from that work where he has more talent and ability. So to fulfill the business needs the outsourcing option is the best recommended.

In How Economics Saved Christmas, economist Art Carden retold the Dr. Seuss story of the Grinch who hated Christmas and stole the decorations, food, and presents from neighboring Whoville. Complete this passage from Carden's poem: He reached for his textbooks; he knew what to do He'd fight them with ideas from A.C. Pigou This idea has merit, he thought in the frost A ____ that was equal to _____ cost

Answers

Complete/Correct Question:

In How Economics Saved Christmas, economist Art Carden retold the Dr. Seuss story of the Grinch who hated Christmas and stole the decorations, food, and presents from neighboring Whoville. Complete this passage from Carden's poem:

He reached for his textbooks; he knew what to do

He'd fight them with ideas from A.C. Pigou

This idea has merit, he thought in the frost

A ____ that was equal to _____ cost

A) subsidy, social

B) subsidy, private

C) tax, total

D) tax, external

Answer:

D. tax, external

Explanation:

He reached for his textboks; he knew what to do

He'd fight them with ideas from A.C. Pigou

This idea has merit, he thought to in the frost

A tax that was equal to external cost

Cheers

In practice, the cost minimization strategy can be more expensive than the opportunity maximization strategy. Which of the following is a way in which the cost minimization strategy is less expensive than the opportunity minimization strategy?

a. The loss of unexpected opportunities

b. The cost of extensive monitoring mechanisms

c. The costs of writing detailed contracts

d. The prevention of opportunistic behavior by the partner(s)

Answers

Explanation: the answer would be d

Haver Company currently produces component RX5 for its sole product. The current cost per unit to manufacture the required 65,000 units of RX5 follows. Direct materials $ 5.00 Direct labor 9.00 Overhead 10.00 Total costs per unit $ 24.00 Direct materials and direct labor are 100% variable. Overhead is 80% fixed. An outside supplier has offered to supply the 65,000 units of RX5 for $18.00 per unit. Required: 1. Determine the total incremental cost of making 65,000 units of RX5. 2. Determine the total incremental cost of buying 65,000 units of RX5. 3. Should the company make or buy RX5

Answers

Answer:

1. The total incremental cost of making 65,000 units of RX5

Total Direct Material + Total direct Labour + Variable Overhead cost

Total Direct Material = 65,000 units * $5 = $325,000

Total Direct Labour = 65,000 units * $9 = $585,000

Variable Overhead cost = $65,000 * 10 = $650,000. $650,000 *(1- 80%) = $650,000 *20% = $130,000

Hence, The total incremental cost of making = $325,000 + $585,000 + $130,000 = $1,040,000

2. The total incremental cost of buying 65,000 units of RX5 =

The cost to buy the units = 65,000 units * $18 = $1,170,000

3. The company should be making the RX5 because the total cost of making the 65,000 unit of RX5 is lesser than cost of buying the 65,000 units of RX5

Tim's Taxi Service sold one of its cabs for $9,000. The cab had an original cost of $23,000 with $16,000 in accumulated depreciation. Assuming this is the only asset sold during the year, what is the recognized gain or loss and character of the gain or loss on this sale

Answers

Answer:

The recognized gain is $2000

Explanation:

The carrying value of the cab sold is the difference between the original cost of $23,000 and the accumulated depreciation of $16,000, hence, carrying value is $7000($23000-$16,000)

The cash proceeds from the disposal of then cab are $9000

Gain on disposal of cab=$9000-$7000

Gain on disposal of cab=$2000

Judith George makes an offer to sell a plot of land using a normal letter and states no authorized means by which the offeree, Helga Holmes must respond if she accepts. If Helga accepts the offer using a normal letter, which of the following is true?

A. The acceptance is effective upon dispatch.

B. The acceptance is effective when it is received.

C. The offer is invalid because it fails to stipulate the means of acceptance.

D. The acceptance would be effective upon dispatch even if the means of acceptance is unreasonable.

Answers

Answer: A. The acceptance is effective upon dispatch.

Explanation:

According to mail box rule, an offeree mails out both an acceptance and a rejection to the offeror by giving to statements: (i) an acceptance is effective upon dispatch (means offeree decides to accept) or (ii) a rejection is effective upon receipt.(means offeree decides to reject)

Here, Judith George → offeror

Helga Holmes → offeree

If Helga accepts the offer using a normal letter, the correct statement would be :

A. The acceptance is effective upon dispatch.

Brayden is a general partner in a four-member limited partnership with two general and two limited partners. The partnership is silent with regard to the duration of the partnership, and Brayden wishes to retire.

A) Brayden may withdraw at any time, and the partnership continues.

B) Brayden must give six months' notice before being permitted to withdraw.

C) The other general partner and the limited partner with the largest liability must agree to his withdrawal.

D) The court must grant permission for Brayden to withdraw since the agreement was silent and the other partners and third-party customers of the partnership must be protected.

Answers

Answer:

A) Brayden may withdraw at any time, and the partnership continues.

Explanation:

A partnership is defined as a business venture where two or more people decide to pool their resources together in a business to achieve a particular objective.

Partnerships can be a complex relationship between participants where conflict may rise. To curtail this an agreement is usually written that states conditions for withdrawal, percentage of ownership, division of profit and loss, length of partnership, and partner authority.

In this scenario the partnership is silent on the duration of the partnership, so Brayden may withdraw at any time and the partnership will continue

Tony borrrows $20 000. He aggrees to repay this loan with 15 equal annual payments with the first payment to commence at the end of 5 years. The annual effective rate of interest on the loan is 4%. calculate the amount of annual payments

Answers

Answer:

The amount of annual payments is $2,400.

Explanation:

Given that Tony has obtained a loan for $ 20,000 at an interest rate of 4% per year, and that he has agreed to pay said loan from 15 annual payments beginning after the end of 5 years, we can say that said interest rate will apply to 20 years (the initial 5 without payment, plus the 15 in which Tony will make annual payments). Thus, a final interest of 80% should be applied to the initial sum, which arises from the multiplication of the years by the annual interest rate (20 x 4).

Thus, to the initial amount of $ 20,000 will be added an interest of $ 16,000 (20,000 x 0.8), totaling an amount to be paid of $ 36,000. Then, since that amount will be paid in 15 annual payments, each of those payments will be made for a value of $ 2,400 (36,000 / 15).

For 15 years, Edward was a compensation specialist at a mid-sized firm. He was laid off when the firm experienced financial setbacks. Edward has decided to open his own business as a compensation consultant to small firms. He can expect that his main source of human capital will be a bank line of credit.

A. True

B. False

Answers

Answer:

B. False

Explanation:

Edward himself is the main source of human capital since he possesses the skills and abilities necessary for performing the consulting services. A bank line of credit helps you to obtain money, it will not provide you with human capital. The people employed by a business provide the human capital.

On December 31, 2018, Gardner Company holds debt securities classified as HTM with a face amount of $100,000 and a carrying value of $95,000. The bonds have an effective interest rate of 6% and pay interest of $2,500 semi-annually on June 30 and December 31. The effective interest revenue recognized for the six months ended December 31, 2018 is:

Answers

Answer:

$2,850

Explanation:

Given the following :

Face value of security = $100,000

Carrying value = $95,000

Effective interest rate = 6%

Interest paid semianually = $2500

The effective interest revenue recognized for the six months ended December 31, 2018 is:

IF effective interest rate = 6%

Semiannual interest = 6% / 2 = 3%

Therefore effective interest revenue for six months will be the product of the carrying value and the interest rate within the six months period :

3% = 0.03

0.03 * $95,000 = $2,850

Wendy has had a life insurance policy for five years with her spouse listed as the person who receives the benefit if she dies. She was recently divorced. Which of the following provisions should she take action on?

a) Incontestability clause

b) Misstatement of age provision

c) Naming a beneficiary

d) Policy reinstatement

e) The grace period

Answers

Answer:

Option C

Explanation:

In simple words, A designated beneficiary , often termed as named beneficiary, refers to a person who is stipulated by a signed legal contract and who has the right to receive money from a fund, insurance fund, pension scheme account, IRA, or some other digital currency. By the point of transaction several designated owners of a single property would share in the profits.

There is a flexible exchange rate system and only two countries in the world, the United States and Mexico. If the inflation rate in the United States rises relative to the inflation rate in Mexico, it follows that:________.

Answers

Answer: If the inflation rate in the United States rises relative to the inflation rate in Mexico, it follows that: depreciation in the US dollars in terms of pesos.

Explanation:

Inflation is a rate at which the mean price level of a group of selected goods and services in an economy increases over a period of time.

A rise in inflation means that the cost of raw materials increases. Then, workers demand higher wages to survive with the higher cost of living. This rise in prices can also cause greater volatility and uncertainty.It cause the depreciation of the value of currency.If the inflation rate in the United States rises relative to the inflation rate in Mexico, it follows that depreciation in the value of US dollars in terms of pesos.

[Currency of Mexico = pesos]

Tanya is a manager who has the ability to understand and gauge the moods and feelings of her employees with little difficulty. Tanya displays high emotional intelligence. negative affectivity. organizational socialization. introversion. organizational integration.

Answers

Answer: emotional intelligence

Explanation:

From the question, we are informed that Tanya is a manager who has the ability to understand and gauge the moods and feelings of her employees with little difficulty.

The above scenario shows that Tanya has high emotional intelligence because she can read the emotions ad feelings of her employees and use that in judging them appropriately.

When State Farm uses consumer research to create a mental map of consumers that indicates consumers perceive State Farm as conservative, safe, responsive, and convenient, it is interested in _______.

Answers

Answer:

"Brand associations " is the perfect answer.

Explanation:

The brand association seems to be a relation that a consumer establishes with that of the commodity in someone's view, doesn't quite indicate the advantages because, in essence, these seem to be much more subjective. The consumers experience associations on their understanding of the product or service.So that the above would be the appropriate one.